The Road to Weimerica

For decades we’ve been told “deficits don’t matter”. We’re assured that despite cranky fuddy-duddies warning that overspending would result in ruin, everything has been fine. But has it?

Atlanta, GA

July 18, 2025

Imagine buying futures on the number of inches in a foot, hedging how many quarts are in a gallon, or speculating whether the number of degrees needed to boil water will vary from one day to the next.

Suppose you were building a house. On the day the blueprint is prepared, certain quantities of wood, drywall, and wire are specified.

But what if the units of measure move by the minute? On paper, planned rooms appear to shrink or grow while the amount of material remains the same.

It’d be like walking onto an ice-covered lake when the thermometer reads eighty, or discovering you’re twelve feet tall when you haven’t grown an inch.

This is what fiat money has done to the market, and to the culture. By warping the lens it inhibits us from envisioning the future.

Since ersatz cash is available at the click of a keyboard, it enables prodigious spending and enormous debt. And now, like tossing an anvil into a leaky boat, the “Big Beautiful Bill” will make matters worse.

A Look Around

For decades we’ve been told “deficits don’t matter”, and are provided recent experience as empirical evidence. We’re smugly reminded that despite cranky fuddy-duddies warning that overspending would result in ruin, everything has been fine.

But has it? Let’s have a look around.

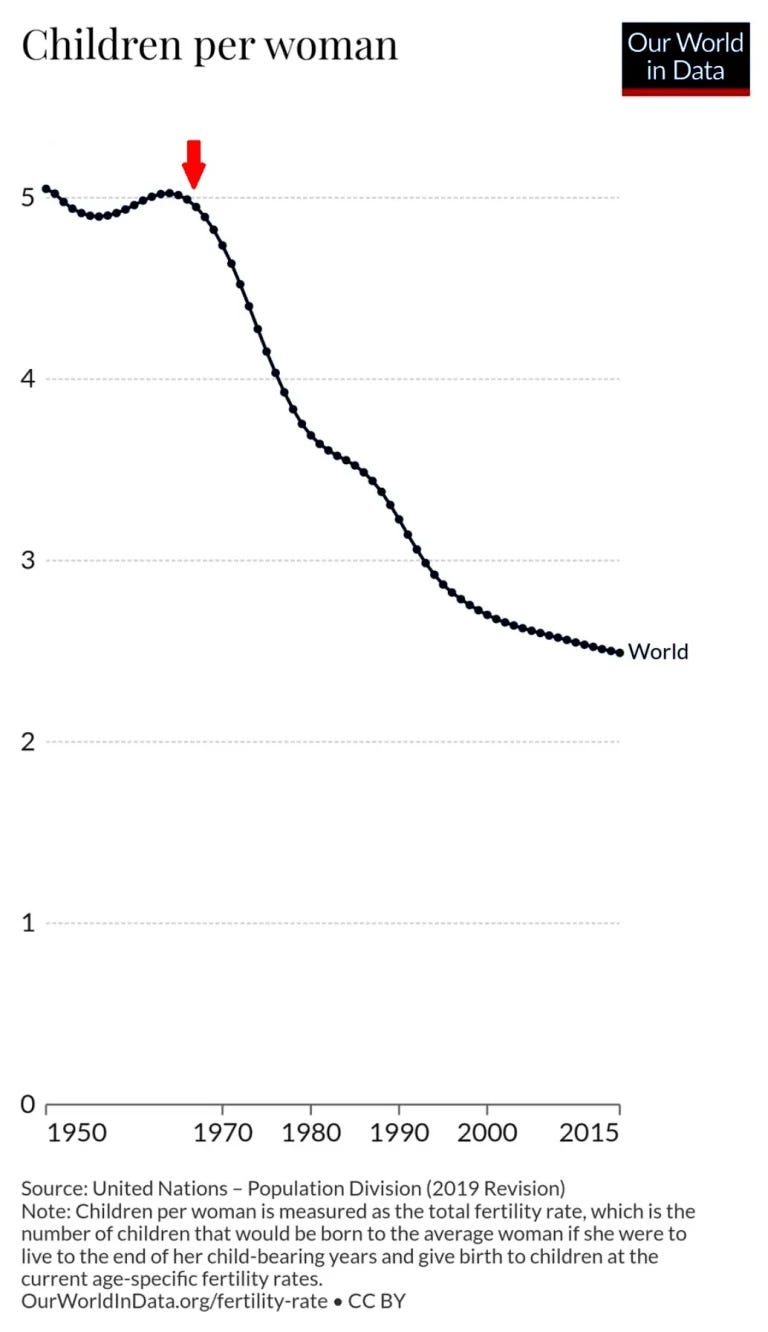

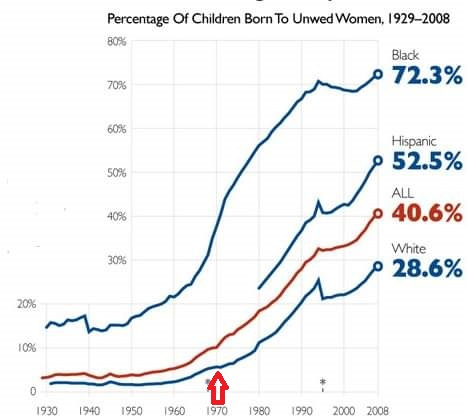

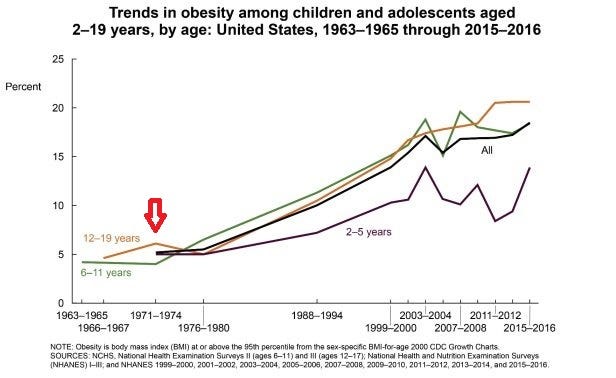

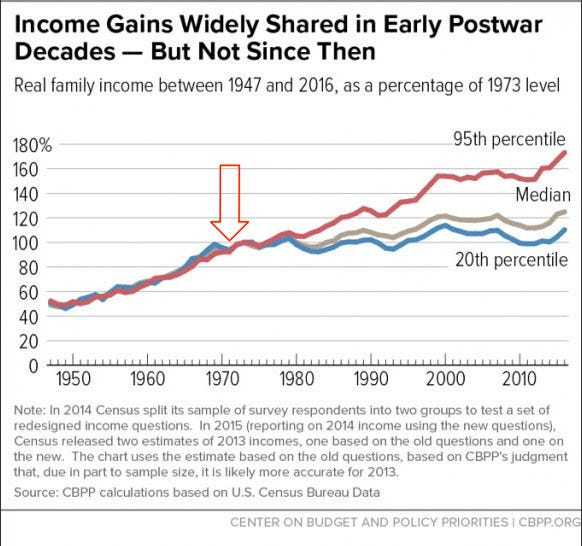

War, crime, decay, poverty, obesity, disease, addiction, drugs, divorce, homelessness, isolation, delayed marriages, declining fertility, falling life expectancy, rising suspicion, racial antagonism, toxic food, and ugly architecture litter the landscape.

Some visual evidence to make the case:

And, perhaps the most important chart depicting cultural decline since an untethered dollar enabled unbridled debt:

After half a century printing money to pay for domestic boondoggles and global empire, large swaths of America that once prospered are now desolate. Most US cities are a mess.

Much of the country is in a state of makeshift maintenance or perpetual decay. The Golden Gate Bridge was built in four years. Fifteen months after the Key Bridge fell into Baltimore Harbor, much of the roadway still rusts in the water.

Globalization, demographic shifts, and technological disruption certainly contributed to endemic degradation. But each of these factors was amplified and disfigured by the government using debased dollars to spend what it didn’t have.

The upper crust rose during decades of deficits. But most of the loaf stayed stale:

The litany of maladies derives at least in part from an assortment of programs, grants, subsidies, and other government-sponsored expenditures that wouldn’t be possible in a sound money, free market economy. They’re symptoms of a low trust, high time-preference, overly-regulated society cultivated by fake money “financing” unpayable bills, and are emblematic of a culture subsisting on dwindling seed corn.

Everything Goes

We’re often warned the debt is something that’ll hobble “our kids and grandkids”. And it will. But it’s shackling us too.

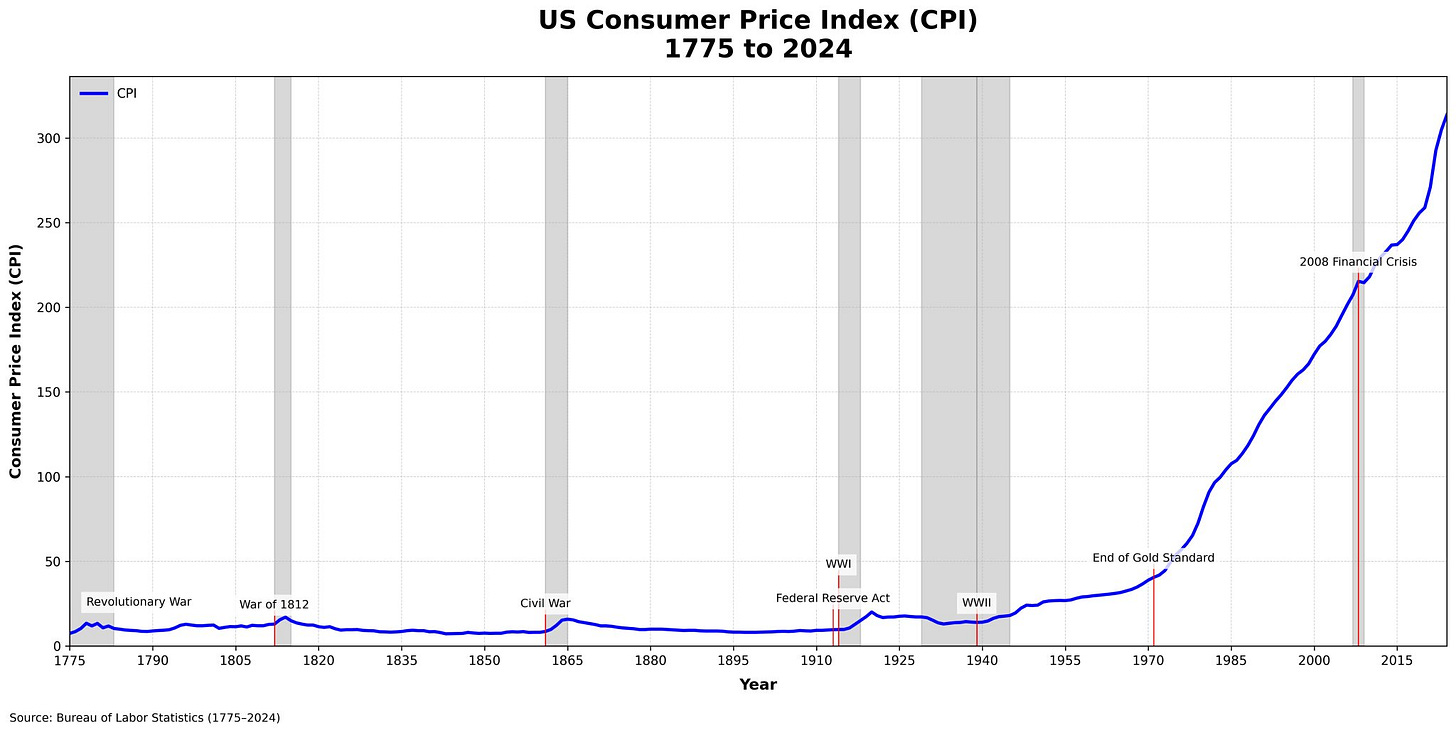

In gold terms, Americans’ purchasing power has declined twenty-fold since 1971. It’s dropped to a tenth of what it bought when this century started, and has almost halved during this decade. Even the CPI shows a crippling erosion:

Gold Price in USD

That ballooning deficits and cultural deterioration accelerated after disconnecting the dollar from gold isn’t happenstance. When the money goes, everything goes.

Sound money abets delayed desire. If people are confident their money will retain value, they are less inclined to rid themselves of it today, and more willing to invest it for tomorrow. Doing so cultivates capital, which nourishes production and multiplies wealth.

In a debt-addled fake money society, time preferences shrink, and short-term thinking prevails. By forcing interest rates below natural levels…like pressing a beach ball under water…central banks finagle the currency to fight the tide. But they can do this only so long before the ball shoots up, and everyone gets soaked.

Under sound money, gratification is deferred to sustain our future selves… including our descendants. We increase savings, suppress primal instincts, and prepare for days yet to come.

But when money erodes, time preference rises, and the present takes precedence. We’re more inclined to down the shot, have the fling, and roll the dice.

Sick Society

Counterfeit currency is distortive, flowing first to the favorable few stationed nearest the spigot. That includes (but is by no means limited to) connected corporations in the financial, munitions, education, agricultural, and medical sectors.

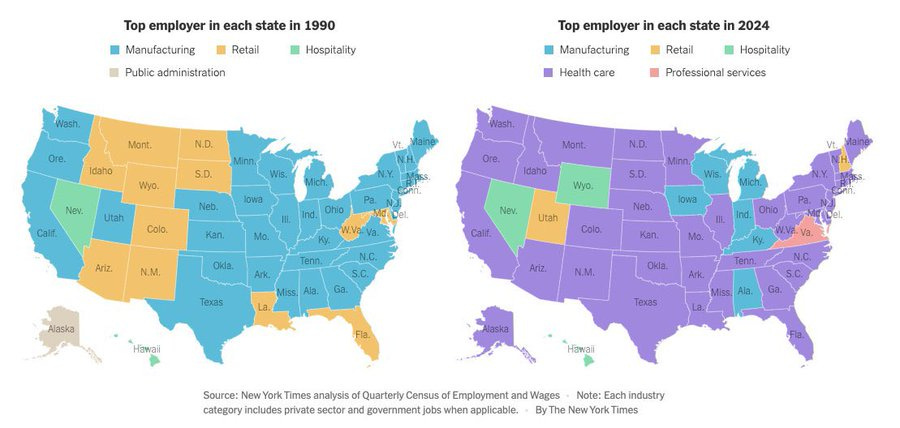

To pick on one of these rip-offs, for fifty years medical spending has been relentless. As recently as 1990, “healthcare” wasn’t among the top four employers in any state. It’s now number one in thirty-nine of them - a sign of a society fiscally sick and physically ill.

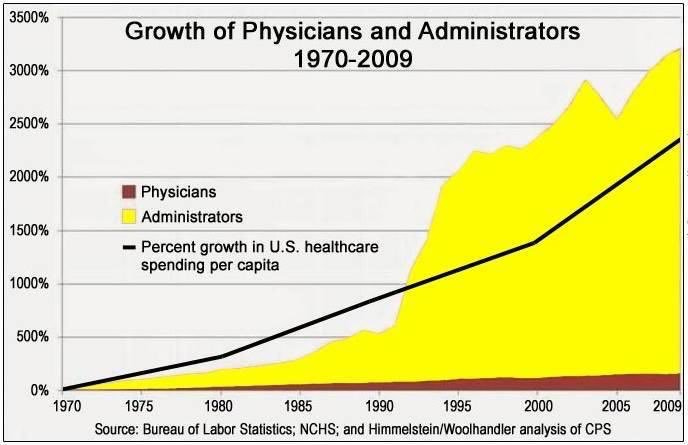

This graph hints where this employment is going:

A chart of university “administrators” relative to college professors would look similar, as would the amount of spending toward higher “education”.

This is how any counterfeiting ring works, by robbing the rubes without them realizing they were bilked. Their wealth is then transferred to insider industries that game the grift.

Fake money fuels deficit spending, which inflates prices of equities and property, enriching those who already own assets. But most people are far from the faucet, and receive the new “money” only after the cost of rent, groceries, and gas have already gone up.

Familiar Odor

The “Big Beautiful Bill” doubles down on debt. With its adherence to war, tariffs, patronage, and money printing, the Republicans really are the “party of Lincoln”. Despite promises of $2T spending cuts under DOGE, the monstrosity they passed will raise annual deficits to at least that amount.

Even based on rosy assumptions that produce understated projections, this bill adds $4T over ten years to a government tab that already approaches $40T. Counting unfunded liabilities (Medicare, Medicaid, Social Security), the hole is almost four times as deep.

As always, the president promises “growth” will fill the pit. At least we know he’s handy with a shovel.

In fairness, some parts of the bill are beneficial, particularly incentives to invest capital in the US. Its most powerful provision is the ability to immediately deduct all R&D and capital expenses for anything built in the United States.

This is especially enticing for companies with multi-billion dollar infrastructure projects, including factories, data centers, pipelines, and battery plants… and should encourage reshoring of supply chains and manufacturing capacity.

Albeit ameliorated by the schizophrenic magnitudes, timing, and targets of tariffs, the retention of tax cuts is also welcome. But much of this breeze bears a familiar odor.

Cutting taxes has been the Republican creed since Reagan ran for office. That’s fine as far as it goes. But it never goes far enough, and usually rides the wrong direction. That’s because even when taxes fall, spending keeps rising.

This means taxes really aren’t being cut, since taxes can’t go down when spending goes up. That’s because spending is the tax.

The Rightful Remedy

Other than mischief, government makes nothing; it only takes. It does so in one of three ways.

The most obvious is overt confiscation, mostly by imposing fees, skimming income, or taking its third-party cut of every sale, inheritance, or other voluntary exchange. These levies are what rise or fall when politicians decide to tinker with rates.

The second way government wrests revenue is by borrowing it, which must be compensated (with interest) by future confiscation. Repayment becomes more onerous (or impossible) as rising debt pulls interest rates up.

The final form of filching is the most insidious and, increasingly, the most common. Inflation is a surreptitious tax that feeds counterfeit currency to connected insiders… crony corporations and contractors working hand-in-glove to pick our pockets.

Under any of these options, reduced tax rates (ideally zero) are always preferable. We’re not forced to lend to the government (yet). And evil and underhanded as inflation is, we can hedge against it if we’re aware it’s happening.

Reduced revenue also helps starve the beast. This not only returns resources to their rightful owners, but any shortfalls it produces may raise interest rates and force future Congresses to cut spending.

Unlikely as that may be, it’s far better than hiking taxes while promising to restrain spending… which merely raises the rate of robbery to fatten the bandit and postpone the reckoning.

There’s also the possibility of outright default. This is admittedly unlikely when the debtor government issues the currency it owes. But it’d be an honest admission of bankruptcy, and has the added benefit of penalizing those who lent money to a reckless entity.

This would also harm people with pensions or plans laden with government debt. But unfortunately, they’ll suffer under any scenario. Default is inevitable; the only question is the form it’ll take. An outright renunciation is the rightful remedy for those who deserve to be punished.

That’s why it won’t happen. As they’ve done during every recession and bailout the last four decades, those in power prefer to inflate the currency, and offload their losses onto hapless holders of US dollars.

As we’ve seen, this “works” for a while. But it eventually leads to “Weimerica”, where a shopper leaves home with money in a basket and returns with purchased goods in his wallet.

That’s where endless debt ultimately leads. When it gets there, maybe most Americans will realize they’ve been paying it all along.

JD

I agree with most of todays writing , except for the beginning chapters of this write up . Most of what You have said at the beginning seems to be a moral story. Just My opinion, What You say about the monetary conundrums is definitely true.

Would be much better if govt paid people for healthy behavior,instead of paying for people's healthcare needs,due to unheathly lifestyles.